WhatsApp may have become a household name when it comes to instant messaging and social media, but when it comes to digital payments, it hasn’t really managed to hold a candle to the likes of PhonePe, Paytm, and Google Pay. Meta, WhatsApp’s parent company, has been actively working to rectify this, and now, it is set to bring support for credit card and UPI payments to its instant messaging app.

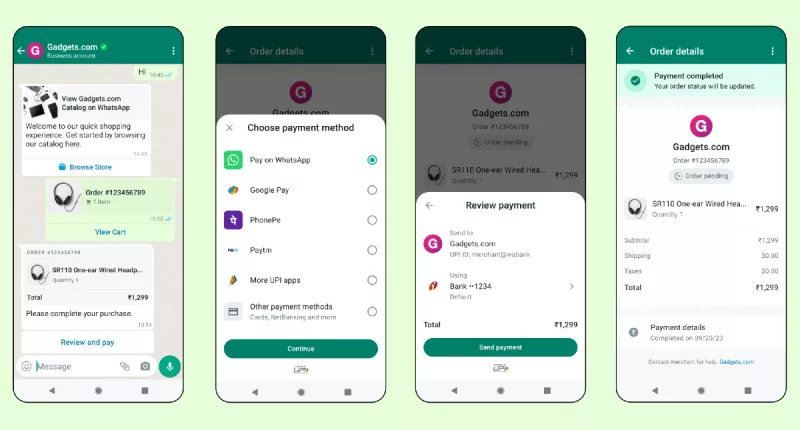

In a strategic move that aims to offer a more seamless and versatile payment experience to users and businesses alike, WhatsApp’s latest update in India introduces a multitude of payment options for users. Partnering with PayU and Razorpay, the platform now supports payments through credit and debit cards, net banking, and all Unified Payments Interface (UPI) apps that are available in India. This diverse array of payment methods caters to the varying preferences of Indian users and significantly enhances the utility of the app.

This announcement follows WhatsApp’s strategic collaborations in the payments sector. Earlier in the year, WhatsApp partnered with Stripe to enable users in Singapore to make payments to businesses through the app. Moreover, in June, WhatsApp introduced merchant payments in Brazil. “This is going to make it even easier for people to pay Indian businesses within a WhatsApp chat using whatever method they prefer,” Mark Zuckerberg, Meta founder and CEO, commented on the matter in his virtual remarks at the company’s Conversations 2023 event in Mumbai.

“We’re making it easier to complete a purchase directly in the chat,” WhatsApp said in a blog post on the matter. “The goal is to help businesses make it more convenient for customers to pay right within a chat, which will help them close more sales,” a WhatsApp spokesperson elaborated, adding that WhatsApp will not be charged for the in-app payments.

This comes at an opportune time, especially since the digital payments landscape in the world’s second-largest internet market has seen considerable growth in recent times. For instance, around 300 million people spend approximately $180 billion monthly via the UPI system. WhatsApp’s move to offer direct in-app payments for rival services and the introduction of credit and debit card options positions it as a formidable player in this thriving ecosystem.

This development can lead to enhanced user experience, letting them choose from a range of payment options, including credit and debit cards, net banking, and various UPI apps. Payments within WhatsApp chats simplify the process of making purchases, eliminating the need to switch between multiple apps or websites. This streamlined experience benefits users by saving time and effort. Furthermore, WhatsApp boasts of an impressive user base in India – one that runs in the hundreds of millions. Businesses that avail of the WhatsApp Business platform can now reach a more extensive customer base. By offering multiple payment choices, they can cater to a broader audience, potentially increasing sales.

Additionally, this can open the doors for a new avenue of monetization for social media company and WhatsApp parent meta – it can generate revenue by charging businesses for delivering marketing and customer service messages to customers through WhatsApp. Additionally, click-to-message ads on Facebook and Instagram that lead users to WhatsApp chats with businesses contribute to Meta’s revenue.

The Tech Portal is published by Blue Box Media Private Limited. Our investors have no influence over our reporting. Read our full Ownership and Funding Disclosure →