Neo-banking in India, just like other fintech sectors, has picked up surging pace, specially in post-pandemic times. From the numbers that startups claim, it seems people have started to opt for neobanks at a much faster pace, as compared to traditional banks. As time has passed, the neobank segment is slowly moving out from its fledgling state and becoming more mainstream. The same has held true in the case of Bengaluru-based neobank Fi, which raised $50 million in its latest funding round led by Eduardo Saverin’s B Capital and Falcon Edge.

With this, the two-year-old Fi is now valued at $315 million, an increase from its previous valuation of $45 million in 2020. According to the startup, the proceeds from the funding round will be used in order to hire people for its tech team and bring more customized products to its users.

“The feedback from users has been encouraging and the app has been well received. We have been focused on delivering a banking experience for digital natives that reflects their personality- simple, smart, fun, and flexible. So we are going to continue to build on our proposition through ecosystem partnerships and a new offering, the funding is an added bonus that will fuel our growth. It is a reflection of the investor confidence in the banking need gap we are trying to address,” said Sujith Narayanan, CEO, and co-founder, Fi.

“We have observed that there is inertia towards saving amongst digital natives. They want to save but never actually get to take proactive steps towards saving. While designing the features for Fi, we have tried to keep the user at the center and build tools that help them overcome this inertia. The uptake of some of these features validates our efforts,” Sumit Gwalani, co-founder, Fi, said.

Founded by former Google Pay executives Narayanan and Gwalani, neobank Fi has also opened up to all users – it was invite-only until recently. This comes amidst the positive response Fi has received regarding its early access launch in April, and now, you can download the Fi app directly from the App Store and the Play Store instead of being waitlisted.

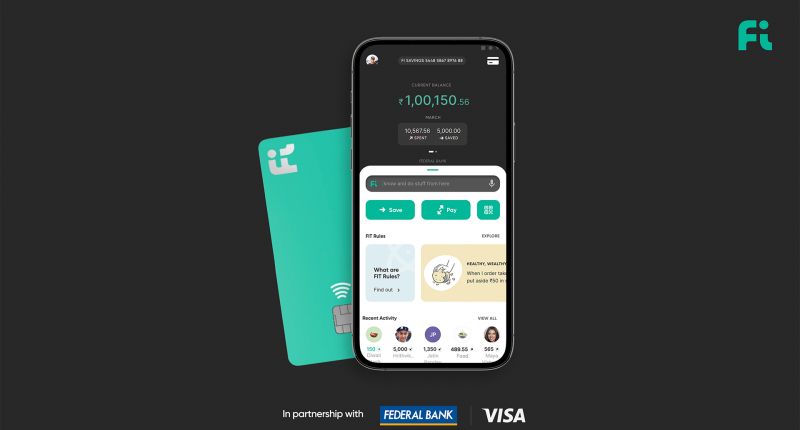

One of the first fintech companies to adopt the RBI’s Account Aggregator (AA) framework, Fi offers digital bank accounts and financial guidance to working professionals between 22 and 35 years, offering them digital banking solutions such as savings accounts and assistance to improve their savings. It claims to have over a million users registered on its waitlist to open an instant, zero-balance savings account with a debit card, which is issued in partnership with Federal Bank.

Currently, it clocks nearly three-four million monthly transactions, and aims to “change the way people perceive and interact with their money.” Its digital financial assistant Ask.Fi leverages “Natural Language Processing” in order to resolve the queries users may have.

The Tech Portal is published by Blue Box Media Private Limited. Our investors have no influence over our reporting. Read our full Ownership and Funding Disclosure →