Reddit, “the front page of the internet”, is inching closer to its highly anticipated initial public offering (IPO), aiming to raise up to $748 million, according to a Bloomberg report. This would be a significant milestone for the company and a potential boon for its investors, making it one of the biggest IPOs of 2024 thus far.

Reddit’s IPO plans involve selling 22 million shares at a price point between $31-34/share, which translates to a potential valuation of $6.5 billion for the company. This figure marks a notable decrease from the $10 billion valuation Reddit sought in 2021 when it first filed its IPO paperwork. Furthermore, Reddit is setting aside 1.76 million shares specifically for its loyal users and moderators. These individuals, who created accounts before January 1, 2024, will be able to purchase these shares during the IPO. These shares won’t be subject to a lockup period, meaning the owners can choose to sell them on the very first day of trading.

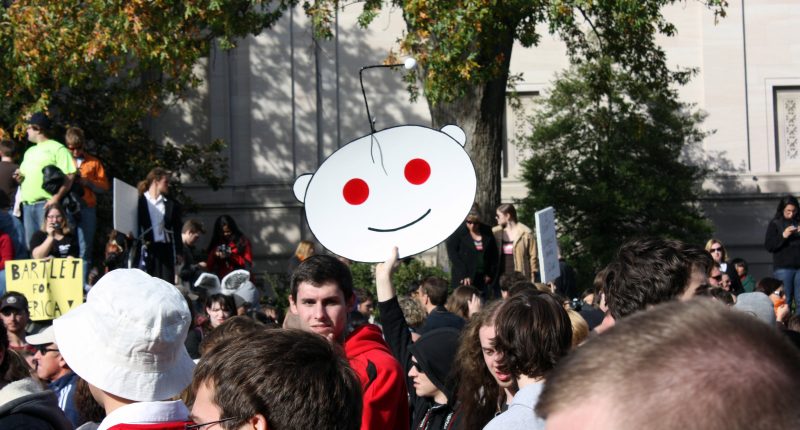

Founded in 2005, Reddit has emerged as a dominant force in the digital realm, evolving into a hub for discussion, news aggregation, and community interaction across a myriad of topics and interests, facilitated through its user-generated content and voting system. This has enabled its growth – the social media platform boasted an average of 73.1 million daily active unique visitors in the fourth quarter of last year. Despite its impressive user base, the company reported a net loss of $91Mn on revenue of $804Mn in 2023. However, Reddit remains optimistic about its growth prospects, banking on its impressive and loyal community.

The IPO, once it occurs, is set to provide the “front page of the internet” with a significant influx of capital, allowing the company to fund its growth initiatives, invest in technology infrastructure, and pursue strategic acquisitions. With access to public markets, Reddit can also tap into a broader pool of investors to fuel its expansion plans, as well as increase its visibility and credibility in the eyes of investors, customers, and partners.

Despite the adjusted valuation target, Reddit’s upcoming IPO is still slated to be a prominent event in the 2024 listings season. This is evident when compared to the earlier, smaller IPO of Amer Sports in January, which raised $1.57 billion. Other companies that are contemplating going public, such as software maker Astera Labs and data security startup Rubrik, are undoubtedly watching Reddit’s offering with keen interest.

Reddit’s journey to its IPO has been a long one, fraught with challenges and obstacles. Three years ago, it first confidentially filed for an IPO, the IPO market in the US was experiencing a boom period. This bullish environment allowed Reddit to secure funding that valued the company at $10 billion. Bloomberg News even reported speculations that the platform could reach a valuation as high as $15 billion in its IPO. Later, an economic downturn forced Reddit to adjust its valuation expectations to a more realistic target of at least $5 billion.