MobiKwik, the payments platform from India, is looking to test the waters of the public markets (much like a multitude of fellow Indian startups), planning to raise about $255 Mn through an IPO as per a DRHP filing with SEBI India.

The 12-year old Gurgaon-based startup, which was founded by Bipin Preet Singh and Upasana Taku, is backed by a number of major investors, including Abu Dhabi Investment Authority and Sequoia India Capital, and has already raised sums totaling up to around $250 million to date.

Now, it is looking to sell equity shares worth as much as $54 million, in addition to new shares worth up to $201 million.

It has filed its draft red herring prospectus (DRHP) with SEBI on Monday, for an IPO of up to ₹1,900 crore in Indian currency. If the pre-IPO placement closes successfully, the total number of equity shares will be brought down as compared to the fresh issue. Nevertheless, the proceeds arising from the fresh issue will be directed towards funding both organic and inorganic growth initiatives.

With bookrunners ranging from BNP Paribas, ICICI Securities, Jefferies, and Credit Suisse, the offer for sale includes a total sum of ₹400 crore (over $53.6 million). These have been divided into ₹9.9 crore by Bajaj Finance, ₹78 crore by co-founder Upasana Taku, ₹111 crore by co-founder Bipin Preet Singh ₹94 crore by Sequoia Capital, ₹11 crore by Cisco Systems, and ₹24 crore by Treeline Asia.

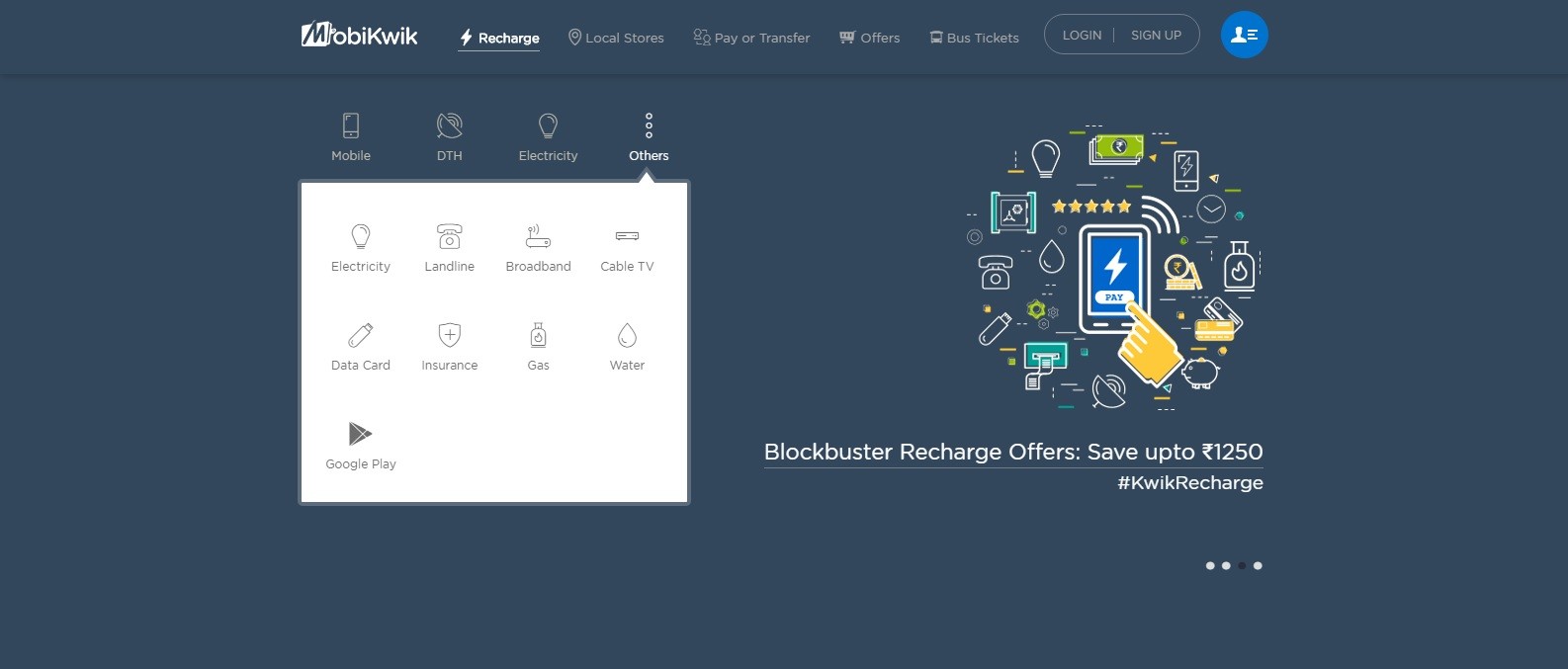

The fintech company, which allows for digital payments and purchases of small loans and insurances, along with American Express-powered credit cards, hopes to sit at valuations of some $1 billion at the end of the IPO.

With a user base spanning more than 101 million registered users, and a connection with 3.44 million merchant partners in online, offline, and billing gateways, MobiKwik claims that its total revenue for the fiscal year that came to a close in March 2021 was around $40.5 million, which is 18% less than the previous year. At the same time, losses also went down by 12%, to hit $14.9 million.

This comes as market leader Paytm readies itself for its own IPO, which could become the biggest financial event of the year for the Indian startup culture.