Indians and strategic investments aren’t really warm with each other. Even though more than 200 million users use digital modes of payments in the country (thanks to some of the cheapest data rates in the world), only a small fraction of them invest in mutual funds and stocks. Groww, a startup that allows users to make investments like these and targets millennials, has seen massive growth in just a few months, thus catapulting it to become the 4th Indian startup to achieve the coveted ‘unicorn’ status in this week.

The firm completed its Series D financing round today, raising $83 million at a $1bn+ valuation. Sequoia Capital India, Ribbit Capital, YC Continuity and Propel Venture Partners participated in the round.

This figure, as impressive as it already is, becomes even better when you compare it to the $250mn valuation Groww had in September last year. Back then, the company had raised $30million during its Series C funding round.

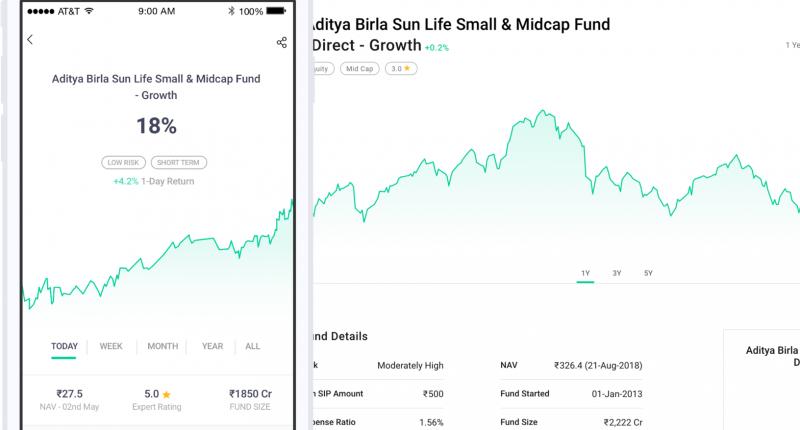

Groww operates an investing platform, allowing millennials to invest their money into mutual funds, including systematic investment planning (SIP) and equity-linked savings, gold, as well as stocks. Moreover, users can also invest in companies listed on U.S. stock exchanges.

Over the last year, as people find themselves confined in their homes due to lockdowns, the demand for investing platforms has increased. Not only do they offer users a new way to pass time, they also allow them to make money if they are strategic with their investments. Moreover, the recent GameStop scenario, which brought Wall Street to its knees thanks to a reddit thread ironically name ‘WallStreetBets’, sparked a lot of interest in the world of stock investment, which could have played a huge part in Groww’s sudden rise to success.

Nonetheless, Groww has joined an ever-going list of Indian startups to achieve the unicorn status. So far, 8 Indian startups have become unicorns since the start of the year, with 4 of them being this week. In fact, earlier today, PharmEasy announced that its parent company has also completed a funding round which valued the online pharmacy at $1.5bn.

The Tech Portal is published by Blue Box Media Private Limited. Our investors have no influence over our reporting. Read our full Ownership and Funding Disclosure →