In a move that has been in the works for months, One97 Communications, the parent company of Paytm has today taken to its blog to announce that Japanese telecom giant SoftBank has invested a staggering $1.4 billion into its fledgling digital payments business.

This is being cited as the largest funding round scored by a digital startup from a single investor in India and confirms the insistent rumors that had been flooding the interwebs over the past few weeks. One97 Communications has been valued at around $8 billion in this fundraising round, which falls short of the estimates made public by the sources. This investment comes on the heels of the massive push from chipmaker MediaTek, who joined Paytm’s growing list of investors earlier this year. The company was then only valued at $4.8 billion, which is a significant jump for today’s round.

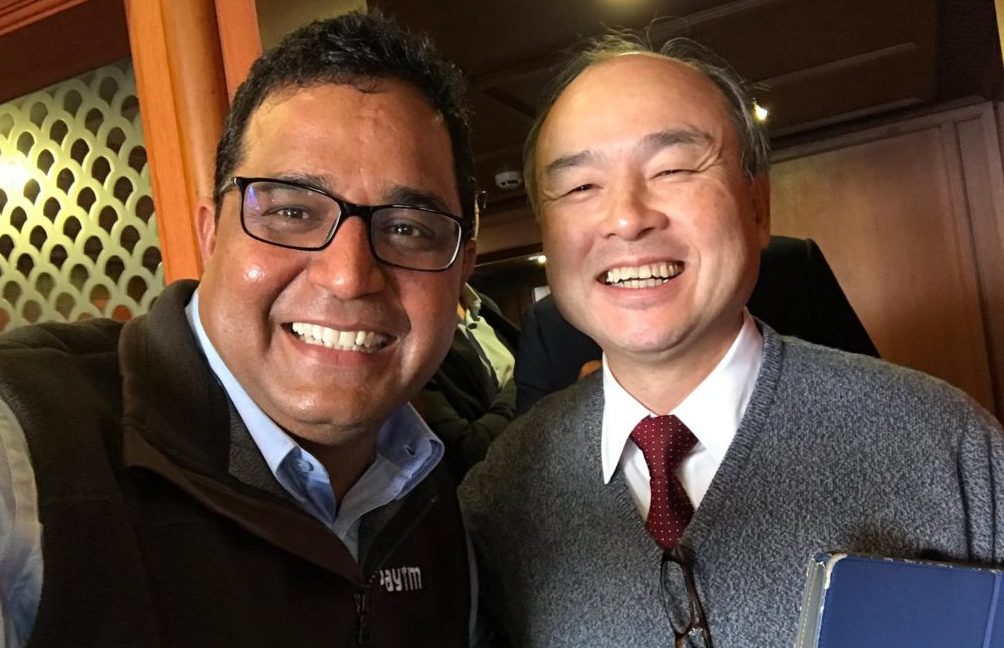

Speaking on the fundraising round, CEO Vijay Shekhar Sharma said:

This investment by Softbank and support of the incredible entrepreneur Masa Son is a great endorsement of our team’s execution and vision. We believe we have a great opportunity to bring financial inclusion to half a billion Indians.

This investment comes at an infliction point for the digital payments behemoth, who is gearing up to make its much-awaited Paytm Payments Bank operational next week. It has received the final licence approval from the RBI and will convert your plain old wallet into a bank account on May 23. It will also employ a chunk of this investment to further expand its userbase by stepping foot in the realms of the global market. The first step, the launch of its services and a 55-member strong team, has already been taken with the debut of Paytm wallet in Canada.

This $1.4 billion fundraising investment will complement the company’s existing ₹10,000 crore (approximately $1.6 Bn) action plan for the next three to five years. It involves onboarding half a billion users on its mobile-first digital bank and expedite the growth of its zero cost QR Code-based payment solution to simplify buying experiences for the masses. It recently invested ₹600 crores in the expansion of its QR Code-based solutions across India.

With this investment, SoftBank is now joining one of its long-standing partner — Alibaba and its affiliate Ant Financial on Paytm’s board of directors. While the Japanese giant is joining hands with the payments major just now, the Chinese e-commerce giant is completely invested into making the company the biggest success from India. Alibaba (and its subsidiary) currently holds over 40 percent stake in One97 Communications and have been adding to it by helping individual investors cash out from the company. It has welcome

Alibaba (and its subsidiary) currently holds over 40 percent stake in One97 Communications and have been adding to it by helping individual investors cash out from the company. And now it is welcoming SoftBank CEO Masayoshi Son to join them in this digital revolution, which has recently blow out due to PM Narendra Modi’s demonetisation move. Paytm was then the largest digital wallet service provider to save the day. Commenting on the same, Eric Jing, CEO – Ant Financial, said:

We are proud to be Paytm’s strategic partner and be a part of the great story as it emerges as the country’s biggest and fastest growing fintech company. We will continue to extend our tech know-how to support Paytm’s growth in the country. And we welcome SoftBank to a great ride together to provide equal access to financial services in India.

Masayoshi Son, Chairman & CEO, SoftBank Group Corp also comments on this partnership as under:

In line with the Indian government’s vision to promote digital inclusion, we are committed to transforming the lives of hundreds of millions of Indian consumers and merchants by providing them digital access to a broad array of financial services, including mobile payments. We are excited to partner with Paytm in this journey and will provide them with all our support.

The Paytm team is currently celebrating the fresh investment that has further added to its already flooding coffers. There is no word on the fate of SoftBank’s primary investment, Snapdeal’s digital payments subsidiary FreeCharge. It has recently been reported that Paytm is interested in picking up the flailing business but the valuation being quoted for the acquisition is appalling.

Sources aware of the development say that it is expected to witness an 80 percent cut in valuation as compared to the $450 million Snapdeal had shelled out to pick up the business. If this speculation turns out to be true then FreeCharge will be acquired by Paytm for as low as $90 million. SoftBank is also said to be pushing the sale of Snapdeal, who’s been feeling the heat of the market and has already slashed its operations, to homegrown rival Flipkart.

With SoftBank coming on board as one of the primary investors for Paytm, the consolidation process being pushed forward by the Japanese telecom giant could get a definite push. We will have to wait to hear more definite news in the coming weeks, so just keep your eyes peeled for more information.

this story is developing..stay tuned for more updates!