Groww has been growing (pun intended) significantly in recent times (especially in the last 18 months, as more and more Indians have been exploring investments). Now, the company’s valuation has tripled to $3 billion in nearly six months (it was valued at $1 billion in April), after the wealth management and investment platform raised $251 million as part of its latest Series E funding round.

The latest round was led by Iconiq Growth, and included participation from Alkeon, Lone Pine Capital, and Steadfast, as well as existing investors Sequoia Capital India, Ribbit Capital, YC Continuity, Tiger Global, and Propel Venture Partners.

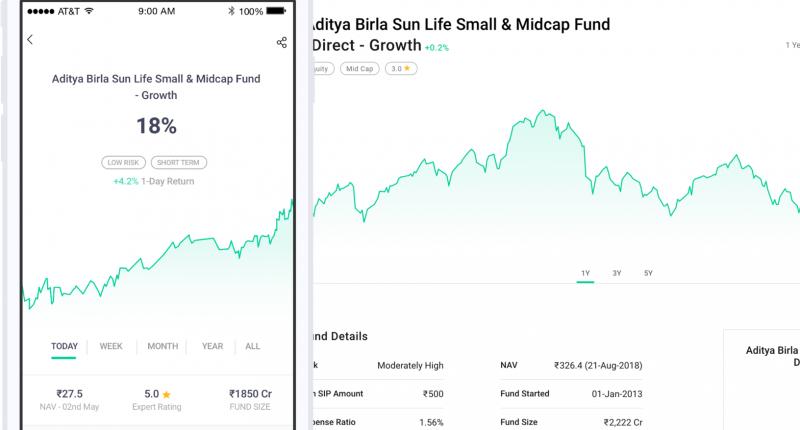

The five year old start-up, founded by Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal, is known to help users invest in mutual funds, futures, exchange-traded funds (ETFs), derivatives, stocks, and IPOs. It also provides tools for stock and portfolio analysis for investors and has millions of users on its platform.

Additionally, 70% of its investors come from tier-2 and 3 geographies.

The fintech unicorn had launched stock investments on its platform in July last year.

The start-up aims to widen the range of its offerings and will use the proceeds from the funding round to expand its technology infrastructure and widen its reach to under-penetrated regions, as well as strengthen its team and continue to make significant investments in creating financial education and awareness about investment products.

For now, it will continue working hard to build an iconic and trusted brand out of the world’s second-largest internet market. Today, Groww ranks among the largest mutual fund distribution platforms in India and registers more than 250,000 new SIPs every month.

Yoonkee Sull, a partner at ICONIQ Growth, said, “The financial services market in India is already large, growing rapidly, and ripe for disruption. During the last couple of years, Groww has demonstrated that they are ready to seize that opportunity through strong accelerating momentum predicated on strength of technology.”