Twitter may be having a challenging time in the world’s second-largest internet market, but that is not stopping the company from making headlines. This time, Twitter co-founder and CEO Jack Dorsey’s small business payments company Square is set to acquire ASX-listed Buy Now Pay Later (BNPL) platform Afterpay for a gargantuan $29 billion at a premium of more than 30% to Afterpay’s last close, to create a global transactions powerhouse, marking the biggest-ever buyout of an Australian firm.

The two companies began talks more than an year ago, and Square was confident that there was no rival offer. In the absence of a “superior proposal,” it looked like the deal was close to deal, according to Ord Minnett analyst Phillip Chippindale, who added that it “brings significant scale advantages, including to Square’s Seller and Cash app products.” As part of the transaction, Afterpay co-founders Anthony Eisen and Nick Molnar will join Square, which will appoint one Afterpay director to its board.

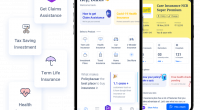

The seven-year-old Afterpay has a base of 16 million consumers and 100,000 retailers globally and operates in Australia, the United Kingdom, Canada, the United States, and New Zealand. Like many fintech firms, it too has benefitted from the surging popularity of online payments, a shift that has been accelerated by the pandemic. It counts among its rivals Sweden-based Klarna Inc, Australia-listed Zip Co Ltd, and U.S. digital payments provider PayPal Holdings. Like other BNPL firms, Afterpay is known for lending instant funds to shoppers, which can be paid off in interest-free installments. Since the company earns from late fees and merchant commissions, it is not required to run background checks on new accounts.

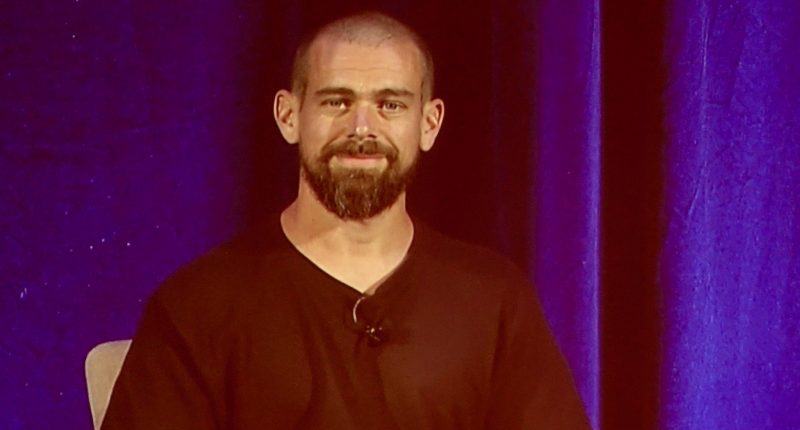

The BNPL sector has boomed as well as firms have grown and evolved. According to Dorsey, Square and Afterpay had a shared purpose, and together they could better connect their Cash App and Seller ecosystems to deliver even more compelling products and services for consumers and merchants.

“We built our business to make the financial system more fair, accessible, and inclusive, and Afterpay has built a trusted brand aligned with those principles,” Dorsey said.

In a joint statement, both companies said that the all-stock buyout would value the shares of Afterpay at A$126.21 ($92.65). Post the buyout, Afterpay’s existing investor Tencent would bid an exit. Additionally, the shareholders of the fintech start-up are expected to own about 18.5% of the combined company.

“The transaction marks an important recognition of the Australian technology sector as homegrown innovation continues to be shared more broadly throughout the world,” Eisen and Molnar said. “It also provides our shareholders with the opportunity to be a part of future growth of an innovative company aligned with our vision.”