India’s mobile payments firm MobiKwik is topped up to the brim with achievements. And there is one more coming its way. It has reached a turning point, very few of its local peers can even reflect on: not frittering away money. The 10-years-young Gurugram-based company headed by Bipin Preet Singh claimed that it is now propagating a profit excluding interest, taxes, accounting allowance, and disbursement.

MobiKwik will double down its fintech scale in 2020 to make FY21 its first full year of profitable growth, says co-founder Upasana Taku. “We have been in an ecosystem where we have seen a lot of high-growth and several regulatory changes in the payments domain. But what we realized was that payments alone is likely not going to be a very profitable business,” Bipin Singh added.

The firm has adapted a number of pragmatic policies and made a number of significant changes to its business in the past half-decade.Paytm , a heavily backed India based firm has raised more than $2 billion to date, despite this fact, Paytm still remains unprofitable,and an analysis of its financial performance shows that this is not going to change anytime soon. Needless to say that Google, also offering an e-wallet facilty in needs, will never fall short of cash (which is quite obvious). MobiKwik has raised about $118 million to date from Sequoia Capital, American Express, and Cisco Investments among others.

Upasana Taku, co-founder and COO of MobiKwik, claimed that the company has taken inspiration from Kotak and ICICI banks, both of which have about 15 million to 20 million customers — a fraction of many digital payment apps — yet profitable. MobiKwik, which employs 400 people, has 110 million users, she said.

The company aspires to become the first Indian fintech and first Indian payments firm to get listed in the country.

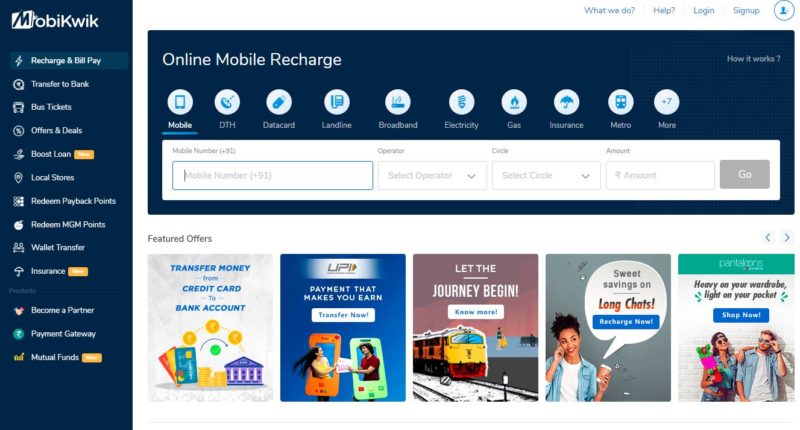

In the past two and a half years, MobiKwik has reduced cashbacks it banters out to users — a practice followed by every company (like Paytm, PhonePe) offering an online payments solution to Digital India — and knuckled down to building financial services on top of its wallet app to absorb customers and thrive on additional sources of revenue.

“Even the population that has access to smartphones and cheap internet data can’t get a credit card in India. We found it a good match for the growth of our payments app. We started serving these users who have the discipline to repay money and have certain kind of income,” the founders stated, who are now also putting on the role of angel investors.

Let’s cut to the chase, when it comes to financial matters India remains still under-served. Fewer than 50 million credit cards are in circulation in the nation currently, and for lower-middle-class people who forms a huge chunk of the Indian population, getting a loan of any size remains a major challenge. MobiKwik works with banks and other lenders to finance loans between Rs 5,000 to Rs 1,00,000. Within 18 months since it started offering this, MobiKwik has provided 800,000 loans and disbursed $100 million.Now that’s a substantial achievement for a 10-year-old firm.

MobiKwik wants to bring a “shampoo-sachet” concept to the insurance sector. The company has collaborated with standalone health insurer Max Bupa to offer a slew of “bite-size” insurance products in the medical insurance segment.In late 2018, the company started “sachet-sized” insurance plans to provide safeguard from cyber fraud, fire, accident, and hospitalization. These plans start at as little as Rs.20 and has persuaded thousands of users to buy these everyday. It also lets users to buy mutual funds for as little as $1.3.

MobiKwik expects its revenue to hit $66 million in the financial year that ends in March next year, a great leap from the $28 million it did a year earlier. It expects to turn fully profitable by fiscal year 2021,and plans to go public soon in four to five years.

The Tech Portal is published by Blue Box Media Private Limited. Our investors have no influence over our reporting. Read our full Ownership and Funding Disclosure →