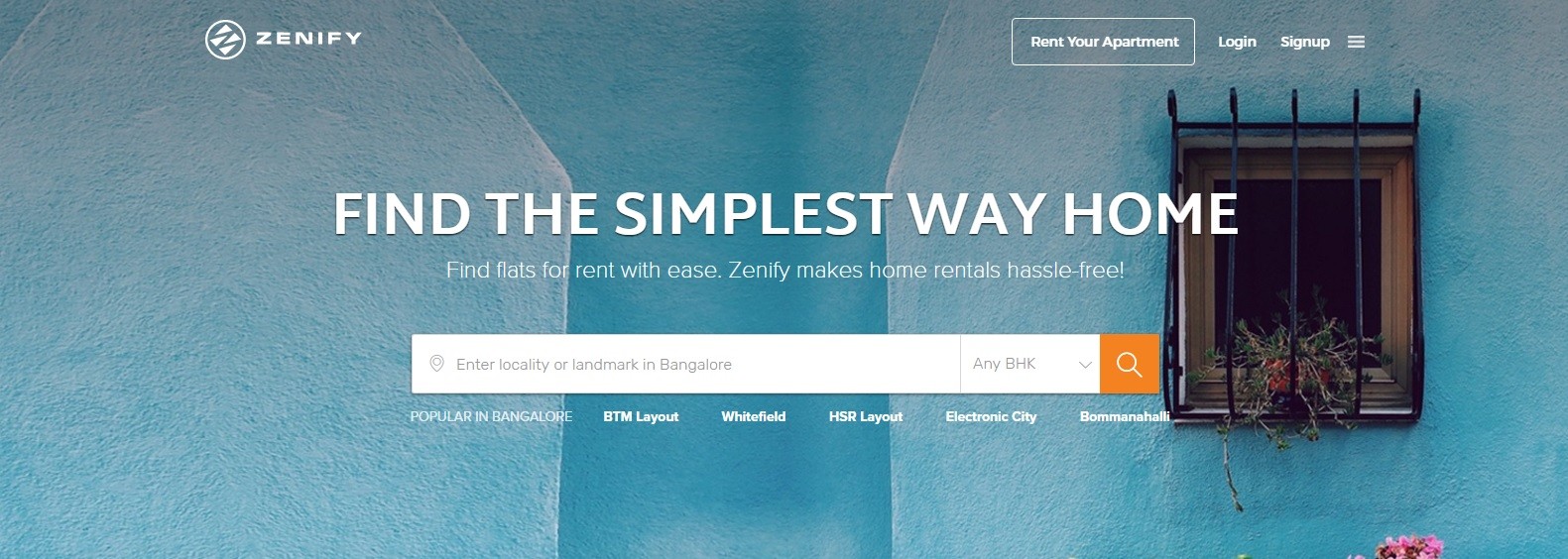

NestAway Technologies, an online home rental startup, has reportedly acquired Bengaluru-based home aggregator and rental management company Zenify in an all-stock deal.

While the company has refused to reveal financial details related to the deal, and its nature, reports suggests that the deal is values Zenify at around $10 million.

Post acquisition, Zenify will continue to operate as an individual brand and will add to the family rentals business started by NestAway. The Zenify team of over 100-members will continue to work with the brand.

Amarendra Sahu, CEO of NestAway, said,

The current acquisition will add 4,000 homes to NestAway’s family rentals business. Zenify will continue to operate as a separate brand under the NestAway umbrella and we will do some cross-linkages in terms of inventory on the family rentals business. Zenify will not list any shared properties. Going forward we will figure out what is working on each of the platforms and think about merging or not.

Ankur Agarwal, co-founder of Zenify, said,

We are really happy and excited to be part of NestAway family. With coming together of the two biggest players in the real estate services segment, we will leap ahead of the competition.

Founded in 2015 by a team of four graduates – Amarendra Sahu, Jitendra Jagadev, Smruti Parida and Deepak Dhar, NestAway was started as a platform for shared accommodation. It claims to manage more than 10,000 homes in Bangalore, Delhi, Gurgaon, Noida, Ghaziabad, Hyderabad, Pune and Mumbai.

The platform lets users discover housing rentals and house owners rent their properties on NestAway’s platform, in a completely different manner though. At Nestaway, once a house gets listed, the startup makes sure that the upcoming tenant gets a full-furnished home, at its poshest best, thus providing an affordable housing solution to singles entering strange new cities for work.

It has close to 1,000 family properties listed on it out of the 10,000-plus homes under management across eight cities in India. The company, backed by Tiger Global, Yuri Milner, and others, has raised $43 million so far and is currently said to be in the market to raise a $30 million round.

The segment has witnessed consolidation in the recent past. For instance, Quikr acquired Grabhouse in an all-stock deal for about $10 million in November last year.

The Tech Portal is published by Blue Box Media Private Limited. Our investors have no influence over our reporting. Read our full Ownership and Funding Disclosure →