Plum, the Bangalore-based group health insurance startup, has raised funds worth $15.6 million in its Series A funding round. Tiger Global, which has off-late come back to its erstwhile active-self, emerged as the lead investor in the round. Apart from Tiger Global, the startup also saw participation from existing investors, chiefly Incubate Fund, Tanglin Venture Partners, Gemba Capital, and Surge (which is backed by Sequoia India Ventures).

This Series A financial round is the second influx of capital for the firm this year. Plum had earlier raised $5Mn in an Angel round, a few months back.

Plum is a health-fin startup focused on providing quality health insurance plans, both as groups, or a retail insurances. India’s healthcare insurance scenario is grim, which received a further setback with the surging COVID-19 2nd wave that saw the country officially reporting over 4,000 deaths on a daily basis. Plum is looking to tap into this vast pool of un-insured Indians, even though there is risk of unawareness.

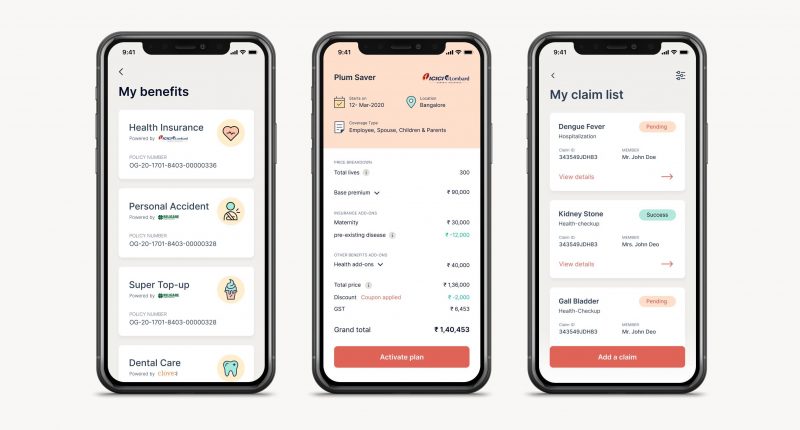

Plum’s packages include a wide range of offerings, from term life plans, to accidental covers. All members of the family, including parents, are covered under the plans provided by the company. It is the B2B segment wherein Plum seems to have clicked brilliantly. Its group insurance plans are tailored to fit the needs of startups/SMEs, which mostly stay away from employee insurance due to burdened compliances and costs. Plum is re-imagining the employee health insurance stack by forging new underwriting and fraud detection algorithms that allow companies with as few as 7 employees to benefit from group insurance.

This would explain Plum’s popularity among SMEs and newer start-ups, including the likes of CleverTap, Unacademy, Groww, UrbanLadder, Simpl, smallcase, and Twilio. Coming up are specialized insurance plans for SMEs with as less as seven employees, who lack the capacity of paying annual premiums.

Abhishek Poddar, Co-founder & CEO, Plum said, “Plum aims to reach a milestone of 10mn lives insured by 2025, by changing the employee health insurance space. With Plum, we are making the process transparent, affordable and easy, using tech at scale.

With claims of over 600 organisations on-boarded, Plum claims of a 110% quarter-on-quarter growth rate and leads the industry with a Claims NPS of 79.

The new funds will be used up in strengthening and expanding the engineering, operations, and business development. Prime investors included well known names like Kunal Shah, Roman Saini and Hemesh Singh (from Unacademy), Harsh jain and Ishan Bansal (from Groww), and Douglas Feirstein, among others.

Also, the firm is looking towards strengthening ties with insurers, including giants like ICICI Lombard, Star Health, and Care Health, among others. This will further help it come with more favourable and possibly, affordable, schemes.