In a Seed round led by India’s largest angel network Inflection Point Ventures (IPV), tech-enabled micro-savings application Siply has raised $1 million.

The startup states that the funds will be utilized to expand the team, scale up the technology platform and to conduct initial pilots with the Partners.

“We expect to utilize these funds for further scale up our technology team and bringing on board new partnerships which can help us scale up more rapidly,” CEO of Siply, Sousthav Chakrabarty said in a statement on Monday.

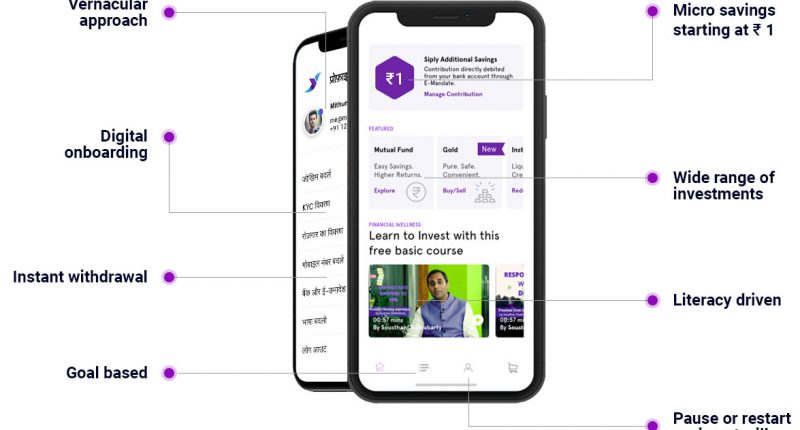

Siply is a fintech start-up founded in July last year, by Sousthav Chakrabarty, Anil Bhat and Nitin Mittal. It is micro-savings app that operates a platform-as-a-service model, allowing its users to save as low as 1 rupee to democratize savings and make India financially independent. It provides frictionless savings, with the help of a wide regional language support, digital onboarding, instantaneous withdrawal, and a wide range of investments.

The startup provides services for businesses and individuals alike. While the former can request for a demo and discuss terms of engagement suited for the organization, the latter just needs to download the Siply app and and register to start saving money in small quantities until they have substantial savings.

Siply has managed to form partnerships Birla, Kodak, UTI, IDFC and Uber, thus showing the huge potential in the idea.

IPV praised the approach of Siply as it is looks to enable the under-banked population of India to start saving. Calling this approach as disruptive idea, the Co-founder of IPV, Ankur Mittal reasons that many fin-tech companies are still not looking at the bottom of the pyramid quite actively, while Siply seems to be focusing right on it. He further stated, “The market they are addressing is largely untapped providing them an opportunity to grow faster and capitalize on their early mover advantage. To help them achieve this ambition, we decided to fund the Company.”

Microlending through mobile platforms has picked up pace in India, where there is a huge unbanked population and credit reach is still very low. Other start-ups which have entered the same fintech field as Siply include Lazypay, Instamojo, ZestMoney, Early Salary, Money Tap, Capital Float and Shubh Loans.

The Tech Portal is published by Blue Box Media Private Limited. Our investors have no influence over our reporting. Read our full Ownership and Funding Disclosure →