RateSetter, a peer-to-peer loan marketplace, has received investment from Australian government’s Clean Energy Finance Corporation (CEFC). It has been exclusively funded to run its green loan marketplace which will sanction loans to borrowers for the purchase of energy efficient products.

These assets include solar and storage equipment, such as solar panels, solar thermals, as well as energy efficient and low emission equipment, including power factor correction, LED lighting, ventilation, heating, and air conditioning.

The company, through this innovative platform, will bring together investors, borrowers and clean energy product providers who have a shared interest in low emissions, energy efficiency and renewable energy projects.

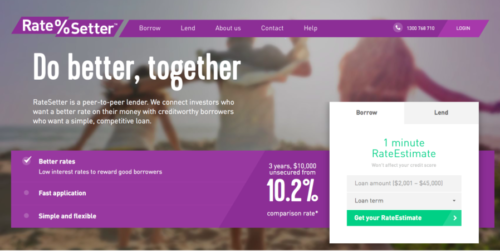

RateSetter builds on the concept of P2P lending, i.e., no “traditional middlemen” are involved, and Australians can lend and borrow directly. Hence, the green loan marketplace will allow investors to lend directly to creditworthy borrowers who are seeking to purchase or install an approved green product. CEFC CEO Ian Learmonth said,

This innovative facility offers the potential to improve the marketability of green assets, by bringing purchasers, installers and manufacturers closer together. There have been green loans before, and there has been peer-to-peer lending, but combining the two into one platform is an Australian first.

Through the online platform, investors can nominate the amount they wish to invest, the interest rate they are ready to accept, and their request can then be matched to approved borrowers. RateSetter CEO Daniel Foggo said, in a statement,

For the first time, everyday investors have direct access – alongside the CEFC and other investors – to stable, attractive returns from a green asset-class, while green borrowers are rewarded with great rates. This highlights the enormous opportunities that can result when innovative businesses and Government organizations such as the CEFC work together.

Richard Lovell, CEFC Debt Markets lead, said their investment in this lending platform had two major objectives. Firstly, the financing will lead to an increase in the flow of finance into the clean energy sector via RateSetter’s retail lender base. Secondly, this investment is aimed to be a catalyst to encourage borrowers to boost their investment in clean energy projects, reducing their energy consumption and also lowering their carbon emissions.

Regulated by the Australian Securities & Investments Commission (ASIC), RateSetter was set up in Australia in 2012 and launched to the public in 2014. It is locally owned and managed, and is backed by the RateSetter group, Carsales Limited, Stratton Finance as well as other investors.

The Tech Portal is published by Blue Box Media Private Limited. Our investors have no influence over our reporting. Read our full Ownership and Funding Disclosure →