Eve Sleep, an online mattress retailer, has managed to rake in £35m by floating on AIM.

Founded two years ago and based in London, the company is now worth £140 million. It has previously raised $20.03 million in equity funding from investors including Octopus Ventures and Woodford Investment Management, with the startup expected to kick off trading on AIM starting 18th May.

Jas Bagniewski, the founder and chief executive, said in a statement:

Today marks a new dawn in our vision to be Europe’s leading sleep brand. With our simplified direct-to-consumer proposition, we are disrupting a fragmented European market, which is forecast to be worth approximately £26bn by 2019. The funds raised will accelerate our growth strategy including through deepening penetration within our ten existing markets, as well as expanding our product range,”

Eve Sleep is just another example of the increasingly blurring (and confusing) line between a tech company and other types of businesses, with the criteria becoming ever more entangled with each other in terms of clear cut definitions.

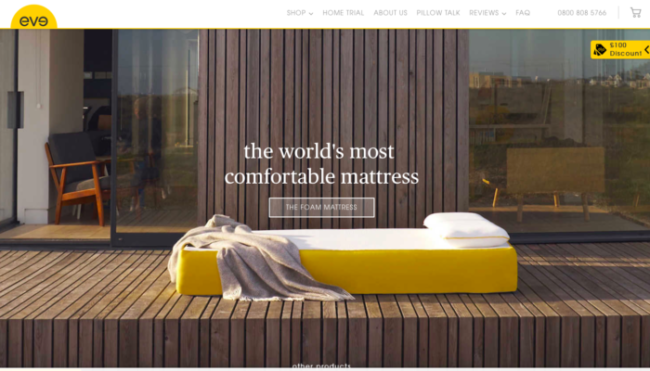

Eve Sleep’s claim to fame is that, unlike traditional mattress retailers, it only operates online, selling just one type of foam mattress. Once it is purchased, it is compressed and shipped off to consumers. The company is also in the business of designing and selling pillows and bedding. It plans to use the new inflow of funds to focus on its advertising and marketing strategy as well as for general working capital.

According to the company, its revenue increased from £2.6 million in 2015 (when it first set up shop), to £12 million last year. It mostly credits its growth to “establishing and increasing market share in the UK, expanding into new overseas market and the introduction of new product lines”.

Luke Hakes, investment director at Octopus Ventures, also one of the firm’s earliest investors, congratulated the team on its flotation, saying:

When we first backed eve back in May 2015, and twice again since, we knew the team were unusually talented entrepreneurs who would dare to go big and create change, and that’s exactly what they have done – including marking the first retail IPO of 2017! We are incredibly proud of having been involved in Eve, and wish the team all the best for their ongoing success.

Update December 2nd, 2017

Eve Mattress has gone public since the publication of this post and trades on the London Stock Exchange under the ticker LON:EVE. Recent industry growth and competition has caused the stock to have higher-than-normal levels of volatility, as can be seen by the market data here. While Eve has accomplished a great feat going public, it’s going to be difficult for it to compete with critically acclaimed companies like Casper who have raised hundreds of millions in funding already and have the first mover advantage.

The Tech Portal is published by Blue Box Media Private Limited. Our investors have no influence over our reporting. Read our full Ownership and Funding Disclosure →