India, a country that has been quite closed up to investing, has recently been catching on. Not only are Indians investing woth great fervor in cryptocurrency, but stocks as well, and Zomato’s IPO is a proof of that. This has led to massive growth for platforms like Bengaluru-based Groww, which allows users to deal in stocks in India. Now, according to a report by TechCrunch, the five-year-old start-up is in talks to close a $25 million funding round to attain a valuation of $3 billion.

The terms of the deal have not been finalized yet and are subject to change. TCV, Tiger Global, and Coatue may lead or co-lead the funding round, and others including Insight Partners may invest as well.

Indian startups have been the talk of the town this year, and the record 26 new additions to the unicorn family in 2021, an increase from 11 last year, is proof of that. The latest Indian start-up to evolve into a unicorn is e-sports and gaming app Mobile Premier League (MPL), and several other firms have raised record capital from global investors to scale up their businesses and expand, and more firms are in talks to walk down the same path and reap the benefits of the ongoing boom in the start-up ecosystem in India.

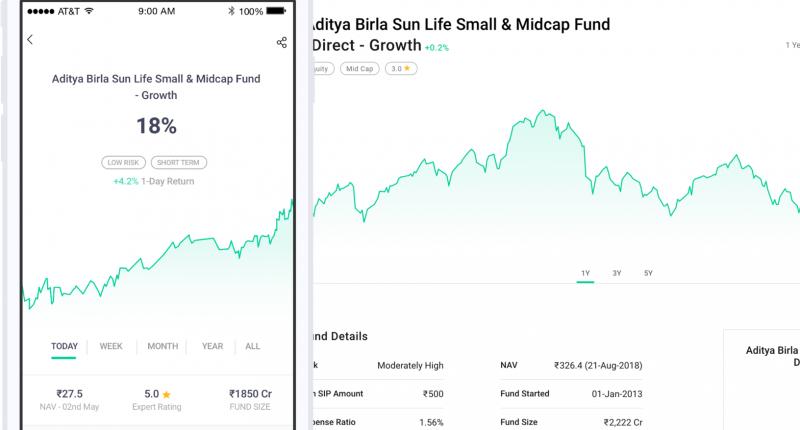

What does Groww do? The start-up, backed by Sequoia Capital, Tiger Global, and others, is known to let its users invest in mutual funds, including systematic investment planning (SIP) and equity-linked savings, as well as gold and stocks – in fact, it offers every fund currently available in the country.

It claims to have more than one million registered users, most of whom are aged below 40. It has come a long way from its initial days as a direct mutual fund platform and currently is on its way to record nearly $35 million in ARR. The start-up is also mulling over venturing into the crypto space, which has gained traction in recent times (in fact, the most popular cryptocurrency was officially recognized as legal tender in El Salvador recently), but the final decision has not been made yet.