PB Fintech, the parent company of online insurance aggregator PolicyBazaar, which allows users to compare between, and choose from, a number of insurance providers and offers to select the one that suits them the best, is gearing up for it maiden initial public offering (IPO). The public issue of shares is expected to fetch sums worth as much as ₹6,500 crore ($870 million).

This would make the SoftBank-backed PolicyBazaar the latest company to join the ever-growing list of Indian firms that are trying their luck at IPOs, from Zomato, CarTrade, MobiKwik, and of course, Paytm (which is expected to go for the highest-grossing IPO that India has ever seen).

The Gurugram-based firm’s parent company has already renamed itself as PB Fintech Ltd., after having passed the special resolution to move over from being a privately owned firm to a public entity. Regulatory filings have been made following the approval of another special resolution in a bid to raise up to ₹6,500 crore via the offer of shares, which will apparently involve fresh issue of shares, as well as offer for sale from existing stakeholders.

Additionally, while it cannot be ascertained whether this move will actually be carried out, some experts say that PolicyBazaar might follow in the footsteps of some other firms, and go for raising a pre-IPO round, consequently decreasing the number of shares offered during the actual offering. Meanwhile, the group has also increased the investment cap for NRIs and OCIs to 24%, up from the previous 10%, as per its filings. Moreover, outstanding convertible preference shares have been converted into equity shares.

If successful, the IPO at PolicyBazaar will become the third-largest in the country, following Zomato, which has already raised ₹9,375 crore through an offering that’s currently underway, and Paytm, which is expected to raise ₹16,600 crore in an IPO later this year.

Morgan Stanley, Kotak Mahindra Capital Co., CitiBank, and ICICI Securities, will apparently be advising the firm, which will be filing its draft red herring prospectus soon, on the IPO. During fiscal year 2021, It has already invested ₹36 crore in a Dubai-based subsidiary, by the name of PB Fintech FZ LLC, whose gross revenue stands at ₹179.44 crore.

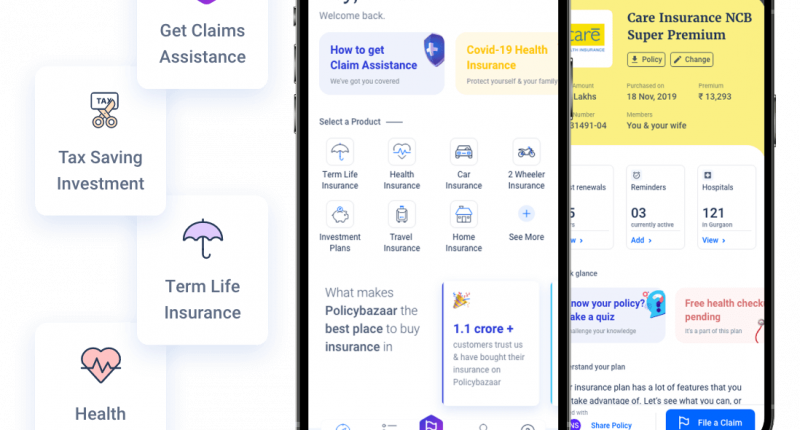

Meanwhile, the Gurgaon-based platform has also recently gotten an insurance broking license from IRDAI, which is a major step ahead from its web aggregator license. This new authorization will allow it to venture into new segments, like offline services, claims assistance etc., while also establishing a Points of Presence network. Moreover, it will also be entitled to charging commissions and fee for web aggregation.